How many of your clients are dutifully saving for retirement? It’s probably safe to wager that the vast majority of your clients have some semblance of retirement savings in place.

Now, how many of those same clients have implemented the added step of protecting their investments in case of a severe illness?

While many retirement conversations revolve around RRSPs and their goal of helping clients maximize their returns, another important conversation involves critical illness insurance and the way in which it can benefit your clients by adding another layer of protection.

If a client suffers a critical illness and needs to take time off of work, or if they need to pay for additional treatment, that income replacement or funding needs to come from somewhere. Without insurance, clients will first dip into their savings… but there are better solutions including using critical illness insurance as retirement protection.

Let’s take a look at a strategy that includes effectively crash testing your clients’ portfolios. The idea is to show your client four scenarios, one of which is guaranteed to happen in their lifetime:

- They don’t have CI coverage and never suffer an illness

- They have CI coverage and never suffer an illness

- They have CI coverage and do suffer an illness

- They don’t have CI coverage and they do suffer an illness

Pick any one of your clients and it’s pretty much guaranteed that one of the above scenarios will apply to them. But which one? This is the impossible part to predict! Most Canadians would like to believe their fate will lead them to option one, but the chance of experiencing a critical illness in their lifetime is 1 in 4 for men and 1 in 5 for women. (1)

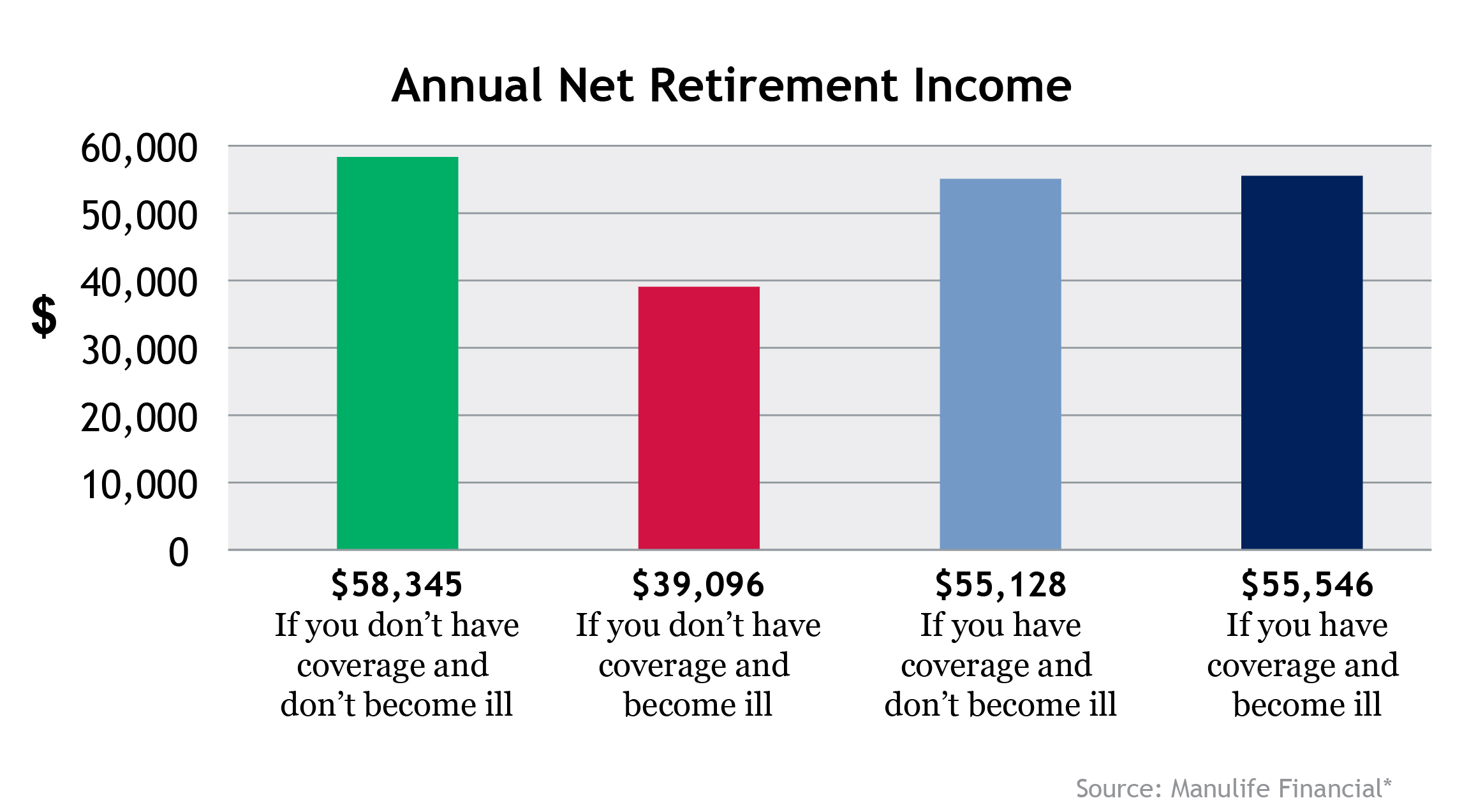

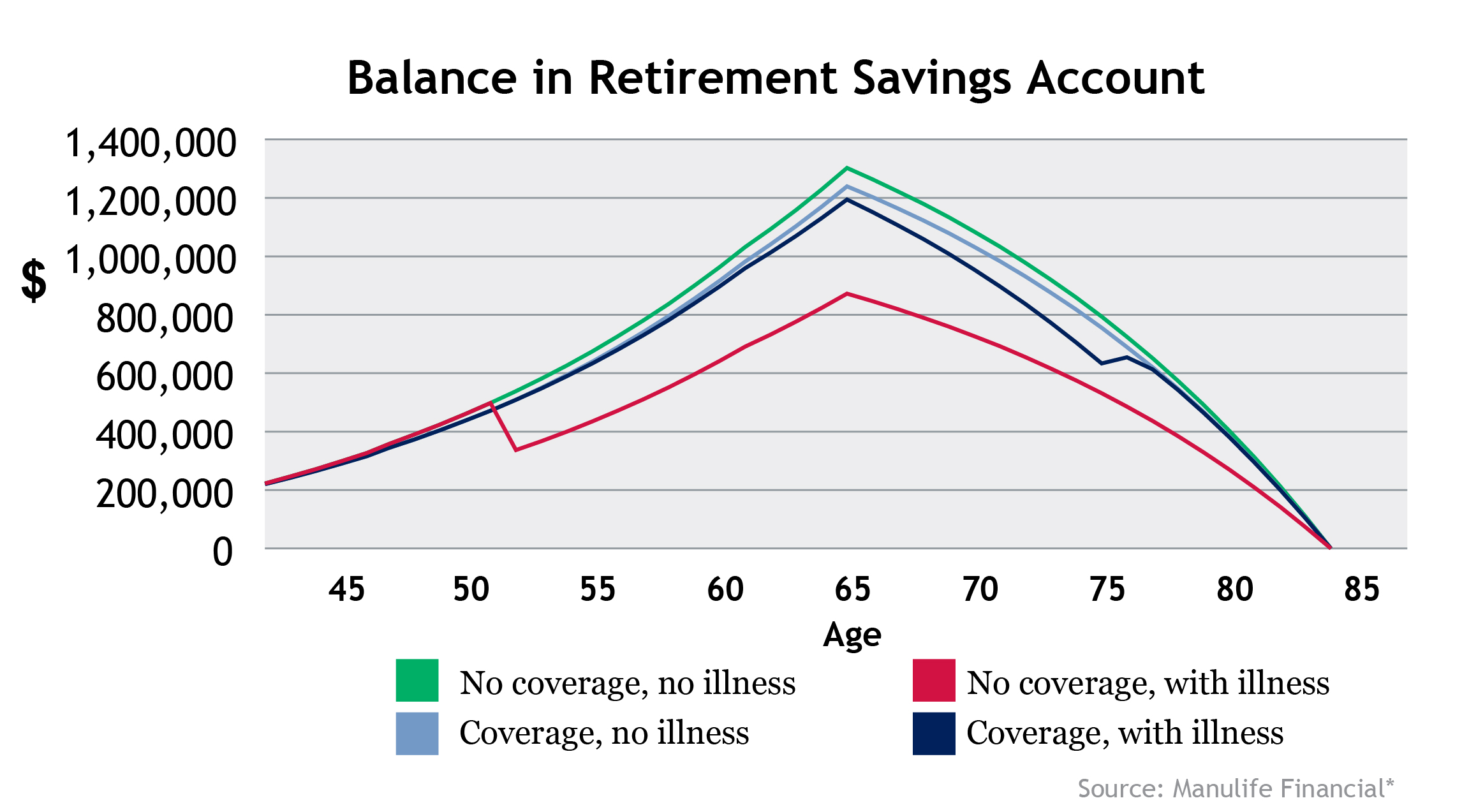

What if you could help show clients the net effect of their decisions and how each scenario can affect their portfolio? Specifically, what if you could show them the real-world impact to their annual net retirement income in each of the above scenarios?

Here’s an example that will help them see the real-world effect on their annual retirement income.

The above example assumes:

- Male Age 40

- $200,000 in RRSPs

- Contributing $10,000

- 6% interest

- $100,000 need at age 50 due to a critical illness

When you compare the ultimate annual retirement income in the scenarios in light blue and dark blue to the best-case scenario green, your clients will see that the impact of redirecting a portion of their savings dollars to the purchase of critical illness insurance is minimal when compared to the impact of becoming ill without critical illness protection. And, if they have additional cash flow, they can cover the cost of the critical illness insurance with no impact to their retirement income.

So, the biggest question is: How can you help to illustrate what this looks like for your clients?

To get started, you’ll need your client’s current registered and non-registered investment balances, future contribution amounts and before-tax rates of return. And for the next client meeting, ask if you can help them crash test their portfolio in case of a health emergency and then run a retirement protection concept for them to see which option they would choose.

For similar content, read Critical Illness Insurance – Financial Protection for Your Client. Also, be sure to share this Strengthening Your Safety Net quiz with your clients to help them assess the risk in their lives and the likelihood of them occurring.

And if you have any questions about how critical illness insurance can protect your clients’ retirement, contact your local PPI Collaboration Centre.

* Manulife Financial LifeCheque Retirement Protect illustration for male age 40, assuming $200,000 in existing RRSPs, contributing $10,000 annually, at 6% annual interest, with $100,000 required at age 50 due to critical illness. Illustrated on January 4, 2022.