Investors are frequently instructed to own a well diversified portfolio in accordance with their risk tolerance and hold it through all market conditions until their situation changes or they are facing a life event. This is all well and true, but for investors entering their retirement years, generating a high return, while important, is only one factor which ultimately influences how long their savings will last. Another important factor is the order in which returns are earned. To put it simply, regular withdrawals diminish the dollar value of a portfolio, and it is precisely this dollar value upon which future returns are compounded. In fact, experiencing negative returns early on can result in running out of savings much sooner than if the portfolio experienced positive returns at the outset.

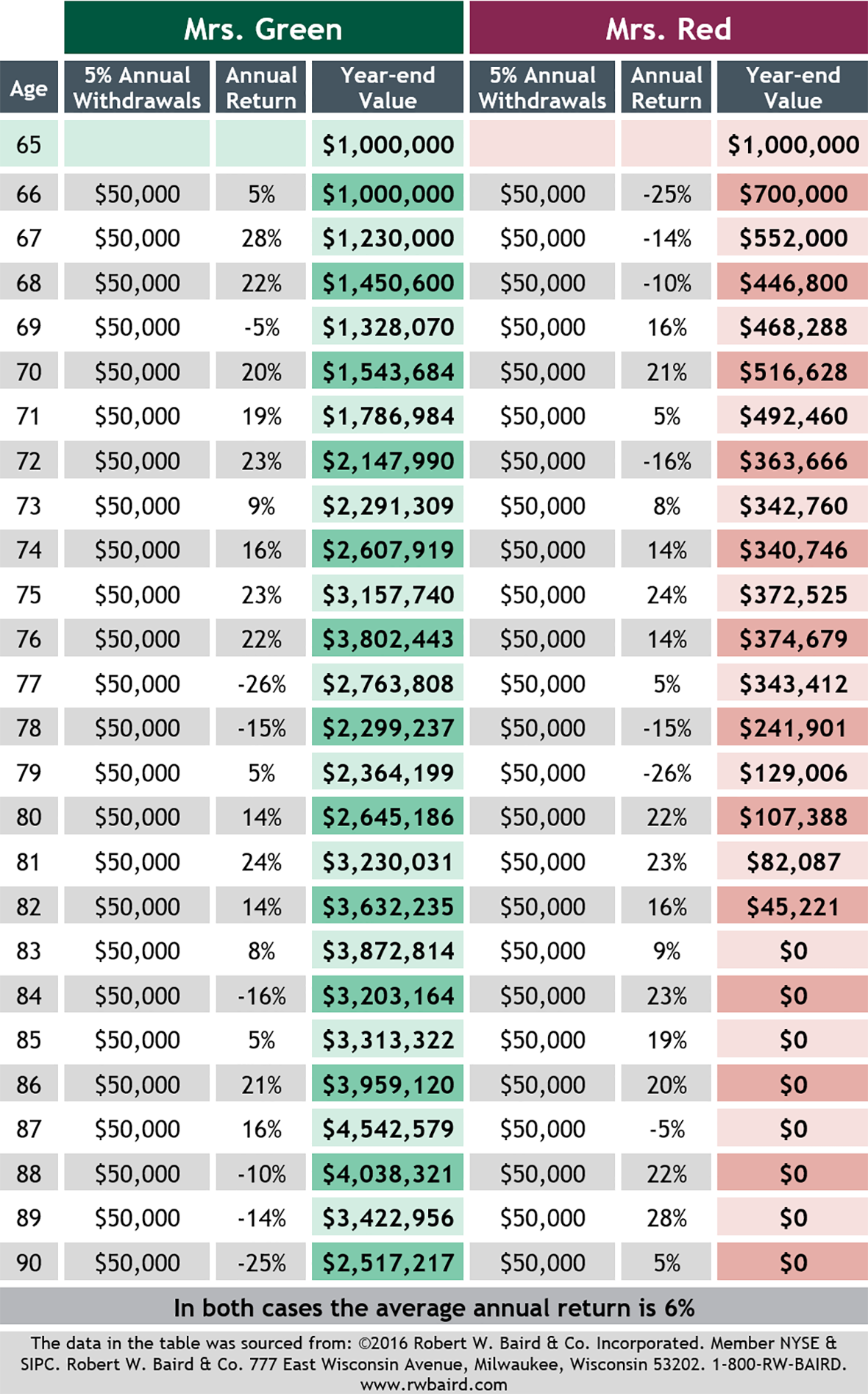

Let us consider the two client scenarios below. In both cases, the new retiree is beginning with $1 million in capital, and both clients will withdraw $50,000 per year. The only difference here is that the sequence of returns has been reversed. That is, Mrs. Green experienced positive returns early in her retirement years whereas Mrs. Red experienced negative returns early on.

As you can see, the annual average growth rate is the same across both scenarios and if there were no withdrawals, the final dollar amounts would be the same too. What we see, however, is that in the scenario where withdrawals are made, the sequence in which returns are earned absolutely matters – Mrs. Red is left with a shortfall at age 83 while Mrs. Green still has $2.5 million at age 90. That’s quite the difference in retirement savings.

Mitigating the effects of market volatility is one way to reduce a client’s sequence of returns risk. Proper diversification among multiple asset classes that don’t correlate and create lower portfolio volatility especially when nearing the decumulation years, can generate income and minimize the risk of drawing down on assets during a down market. While the numbers used in the above example are extreme and unlikely to manifest in actual market conditions, they do illustrate the concept well, namely that the sequence of returns from an investment portfolio experiencing withdrawals can have a material impact on the overall retirement picture and it is prudent to manage this risk.

For more information on sequence of returns risk, contact your local Wealth Team member.

SHARE the client article from The Link Between:

What is Sequence of Returns Risk?